Bottom Line Up Front: Spotify’s launch of in-app messaging on August 26, 2025 represents the streaming giant’s boldest bet on social audio since 2017, targeting TikTok’s dominance in music discovery while leveraging 696 million users to create network effects that could fundamentally reshape how we experience music together. This strategic shift builds on insights from platform ecosystem design and represents a critical evolution in social product strategy.

The stakes couldn’t be higher. While traditional social platforms battle user fatigue and regulatory pressure, streaming platforms face a critical vulnerability: ranking fourth among 16-19-year-olds for music discovery, behind TikTok’s overwhelming dominance. Spotify’s Messages feature arrives at what industry analysts call “the perfect storm” – social fragmentation creating opportunities for music-focused communities to capture unprecedented market share, similar to patterns we’ve seen in AI-driven user experience design and community-building strategies.

How Spotify’s Messages Actually Works

The Technical Implementation

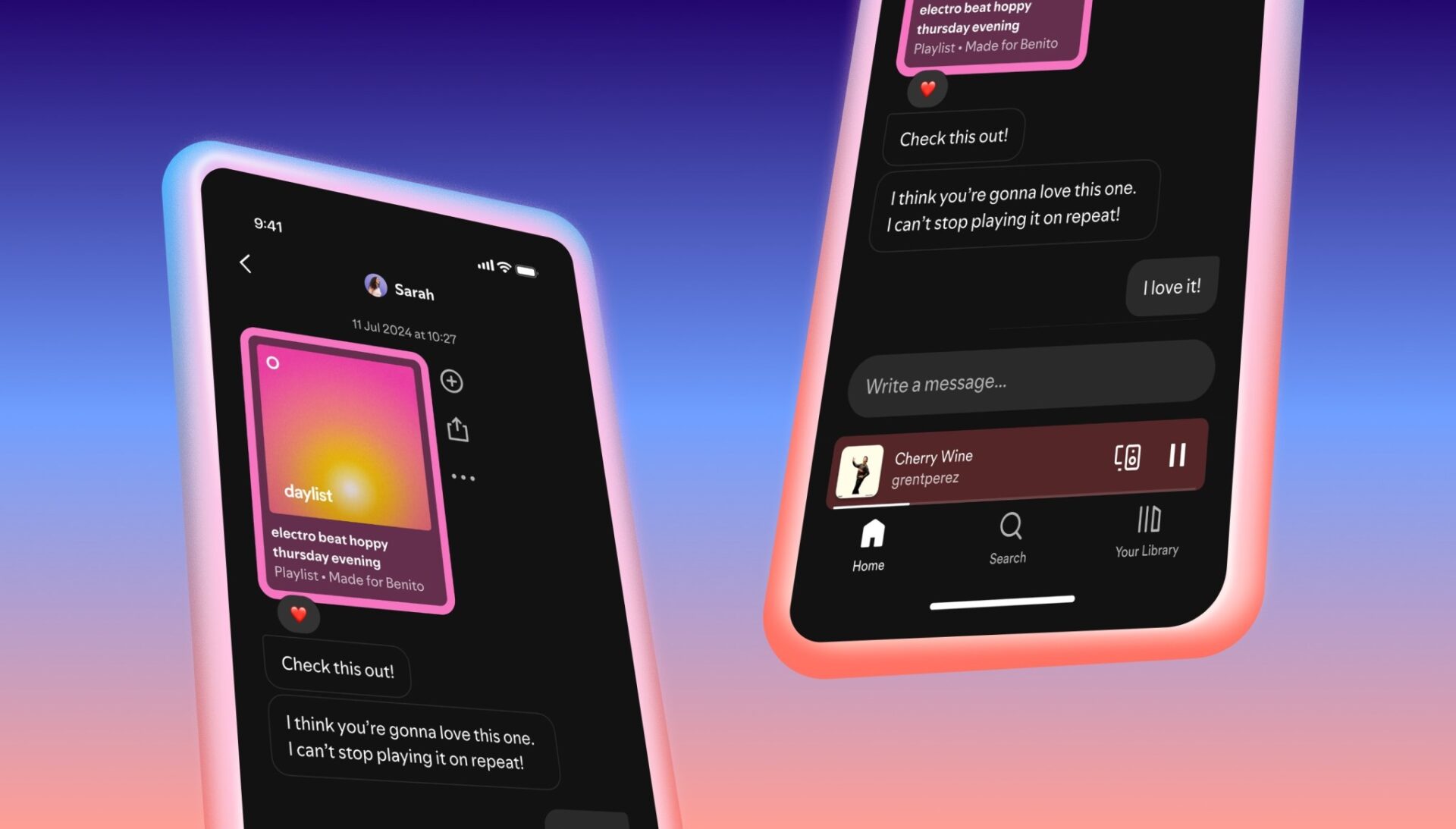

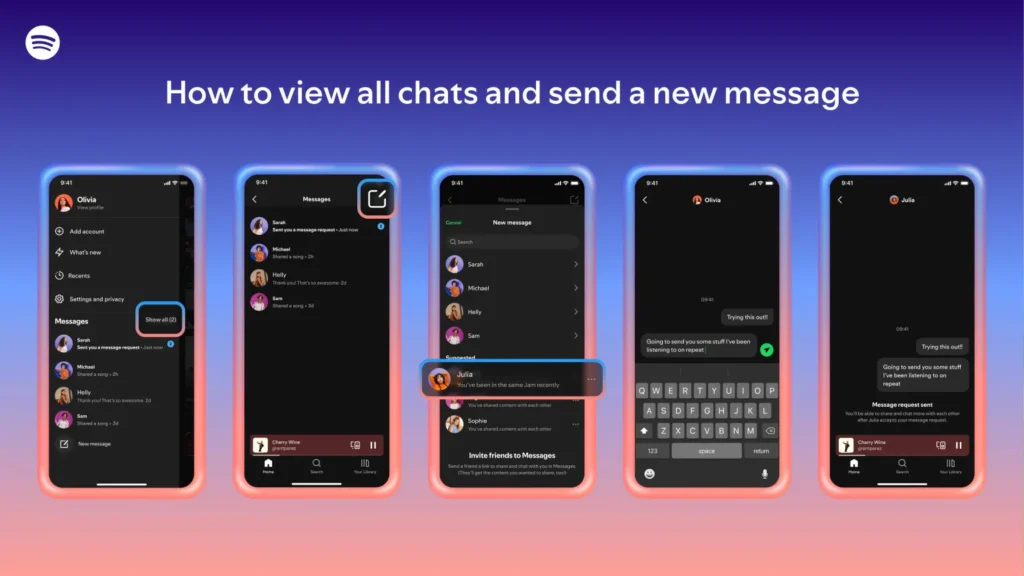

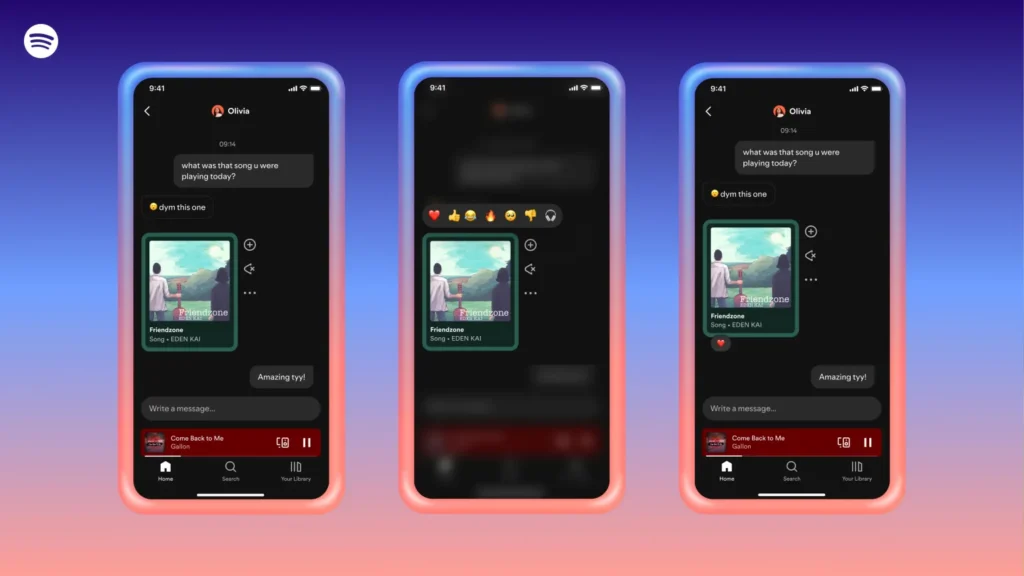

Messages operates as a one-on-one communication system integrated with Spotify’s existing social features rather than competing directly with WhatsApp or iMessage. Users access the feature through their profile photo, leading to a dedicated inbox where music conversations live alongside shared content.

The sharing mechanism builds naturally on existing functionality. While listening to any song, podcast, or audiobook, users tap the familiar share icon, select a friend, and send directly within Spotify. Recipients can react with text and emojis, while shared content begins playing instantly even before message acceptance.

Smart Privacy Controls

Learning from the 2017 messaging failure, Spotify implemented careful restrictions. Users can only message people they’ve previously interacted with through collaborative playlists, Jams listening sessions, Blend playlists, Family/Duo plan sharing, or previous content sharing. This addresses spam concerns while building on existing social connections.

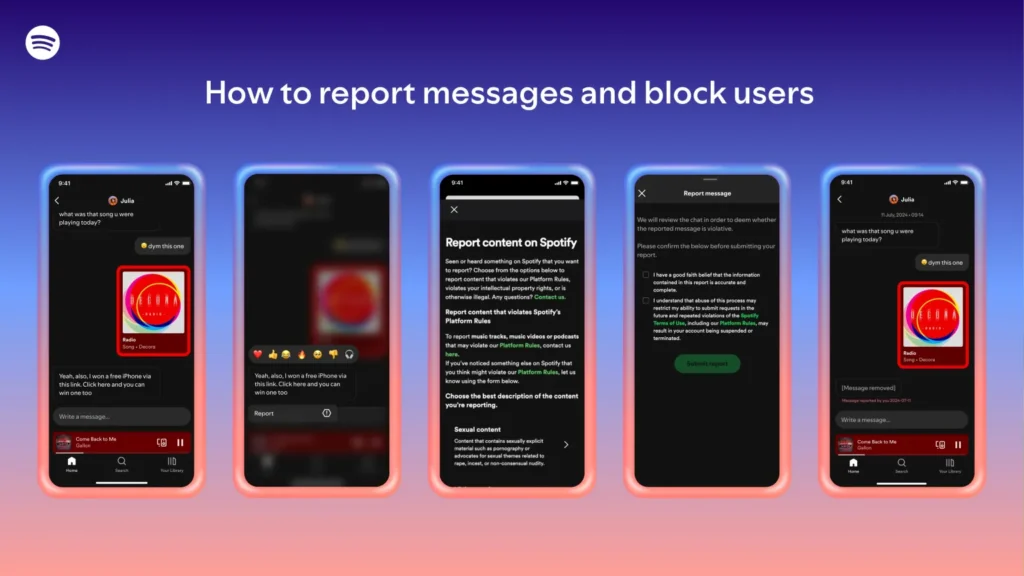

Security features include industry-standard encryption in transit and at rest, though notably avoiding end-to-end encryption to enable content moderation. Users maintain full control through accept/reject options, blocking capabilities, and complete feature disabling through privacy settings.

Global Rollout Strategy

Initially limited to mobile devices for users aged 16 and older, Messages launched first in select Latin and South American markets, with expansion to US, Canada, Brazil, EU, UK, Australia, and New Zealand planned for coming weeks.

Why This Timing Is Perfect

The Social Media Tipping Point

MIDiA Research’s Tatiana Cirisano describes social media as being “at a tipping point,” with users seeking smaller, more gated communities around shared interests. This creates unprecedented opportunity for music platforms to capture social engagement time.

Consider the user attention battle: social platforms now compete directly with Spotify for user time – 7.6 hours weekly on social video versus 6.5 hours streaming music. Messages aims to collapse this distinction by making music discovery social within the streaming experience itself.

The TikTok Problem

TikTok dominates music discovery among Gen Z, but struggles with post-discovery engagement. Users discover songs on TikTok, then jump to Spotify to add them to playlists and share with friends. Spotify’s strategy centers on owning post-discovery conversations rather than competing directly with TikTok for initial music discovery.

This approach acknowledges reality while creating defensible competitive advantages through social lock-in effects and network value that grows with user base expansion.

Competitive Landscape Analysis

Discord: The Unexpected Leader

Discord emerges as the strongest competitor in social audio infrastructure with 200 million monthly active users and comprehensive community organization tools including voice channels, Stage Channels, and rich music integration through bots.

Discord’s success proves users want music-focused social experiences when properly implemented. However, Discord’s complexity and gaming association limit mainstream music adoption, creating opportunity for simpler, music-native solutions.

Apple Music’s Integration Advantage

Apple Music leverages iOS ecosystem integration through SharePlay and collaborative playlists but lacks direct messaging between users. YouTube Music has recently expanded social features with collaborative playlists and fan badges, leveraging its broader creator ecosystem.

SoundCloud’s Creator Focus

SoundCloud leads in creator-to-fan communication with direct messaging tools for artists and granular engagement through waveform comments. This creator-first approach demonstrates monetization potential beyond streaming royalties.

The competitive analysis reveals that while most platforms offer basic social features, differentiation increasingly depends on community feel and integration depth. Spotify’s advantage lies in combining massive scale with native music integration and careful privacy controls – principles explored in our analysis of product differentiation strategies.

The Technical Architecture Behind Messages

Content Moderation Challenges

Spotify’s Messages architecture integrates with existing social features rather than operating as an isolated system, requiring real-time messaging capabilities, content attachment systems, and device synchronization.

The decision to avoid end-to-end encryption enables proactive content moderation through AI detection and human review. Users can report violations by long-pressing problematic messages, triggering Spotify’s existing Terms of Use enforcement mechanisms.

Privacy Trade-offs

Content moderation presents unique challenges for audio platforms, as automated systems struggle with tonality, sarcasm, background noise, and cultural context that human moderators easily interpret. Spotify’s hybrid approach balances user safety with privacy expectations, though at significant operational cost, following content moderation best practices.

Data integration with recommendation algorithms creates both opportunities and concerns. Message content and sharing patterns likely feed into Spotify’s personalization systems, improving accuracy while raising questions about inference capabilities from social behavior – challenges similar to those discussed in our data privacy framework analysis.

Business Model Transformation

Revenue Stream Diversification

Messages supports multiple revenue streams while addressing Spotify’s core challenge of converting engagement into sustainable profitability. Increased time-in-app directly benefits advertising revenue from free tier users, while social features create premium differentiation opportunities.

The feature arrives as Spotify implements global price increases and develops super-premium tiers. Social functionality justifies premium pricing by creating exclusive features and reducing churn through social lock-in effects.

Network Effects at Scale

Spotify’s current scale of 696 million users provides critical mass for meaningful network effects, unlike the 15 million user base during the 2017 messaging attempt. More users create exponentially more potential connections, better algorithms, and stronger platform stickiness – dynamics explored in network effects theory.

Data monetization expands significantly through social interaction analysis that improves user profiling for sophisticated advertising targeting. Friend networks, sharing patterns, and community engagement guide both content acquisition and ad optimization strategies, following principles outlined in our monetization strategy guide.

Creator Economy Implications

New Discovery Pathways

Messages opens new artist discovery and promotion pathways through enhanced word-of-mouth amplification within the platform. Social signals improve recommendation algorithms while collaborative features provide exposure opportunities for emerging artists.

Independent artists particularly benefit from democratized promotion through social features that require no traditional marketing budget. Viral sharing within Spotify’s network can generate significant exposure without external platform dependence.

Direct Monetization Potential

While direct artist-to-fan messaging remains unclear in the initial launch, the infrastructure supports future creator monetization tools. Fan messaging platforms like Fanfix generate significant revenue – over $170 million paid to creators with 60% from direct messaging content.

Revenue diversification becomes possible through social features enabling multiple income streams beyond streaming royalties: direct fan payments, exclusive content distribution, community-driven merchandise sales, and enhanced live event promotion – strategies detailed in our creator economy analysis.

Learning from Historical Social Music Failures

iTunes Ping: The Cautionary Tale

iTunes Ping attracted 1 million users in 48 hours but shut down after two years due to spam problems, limited functionality, and failed Facebook integration. The key learning: successful social features must integrate within primary music consumption rather than operating as standalone networks.

Last.fm’s Gradual Decline

Last.fm, an early pioneer in social music, gradually lost features due to licensing restrictions and now operates primarily as a music tracking service. This demonstrates how licensing complexity can undermine social features over time.

Network Effect Sustainability

Apple Music’s launch demonstrated that lack of viral social features (0.3 viral coefficient) limits platform growth, while retention rates prove crucial for maintaining network value. Spotify’s existing user base and incremental feature introduction address both viral growth and retention requirements.

Privacy and Safety Considerations

Regulatory Compliance

Privacy implications extend beyond individual users through network effects, as social audio platforms can derive sensitive information about health, relationships, and location from audio metadata and sharing patterns.

The EU Digital Services Act and similar legislation will require greater transparency in recommendation systems and user control over personalization. Spotify’s privacy controls anticipate these requirements while balancing functionality with compliance needs – considerations explored in our regulatory compliance framework.

Content Moderation Scale

Operating messaging at 696 million user scale presents unprecedented moderation challenges. Automated systems struggle with audio content complexity, requiring resource-intensive hybrid approaches that balance user safety with privacy expectations.

Strategic Market Implications

The Social Audio Battleground

Industry experts predict that music platforms offering authentic social experiences will capture market share from traditional social media platforms facing user fatigue and controversy.

This represents a fundamental shift from music streaming as utility to music streaming as social experience. Platforms that successfully integrate social features without sacrificing core music functionality will likely dominate the next decade of digital music consumption.

Platform Ecosystem Effects

Technical infrastructure developed for Messages creates foundation for advanced social features including music track comments, enhanced collaborative tools, and potentially live audio conversations. The asynchronous messaging focus aligns with broader industry trends following Clubhouse’s pivot from live-only to persistent communication.

Future Evolution Predictions

Short-term Developments (6-12 months)

- Artist-to-fan messaging capabilities

- Group messaging functionality

- Enhanced content sharing options

- Integration with Spotify’s podcast and audiobook content

Medium-term Expansion (1-3 years)

- Live audio conversation features

- Community creation tools

- Advanced creator monetization options

- Cross-platform integration improvements

Long-term Transformation (3-5 years)

- Full social audio ecosystem

- AI-powered conversation recommendations

- Virtual music experience integration

- Comprehensive creator economy platform

Investment and Market Analysis

Financial Impact Assessment

Goldman Sachs maintains a buy rating with $800 price target, viewing Messages as supporting Spotify’s “scaled compound user growth” strategy. The feature aligns with reaching 1 billion subscribers while working toward sustained profitability through enhanced engagement – metrics tracked in our SaaS growth analysis.

Competitive Positioning

Messages positions Spotify defensively against social media time competition while offensively capturing music-focused social engagement that currently disperses across multiple platforms. This consolidation creates significant strategic value through reduced user friction and increased platform stickiness.

Implementation Recommendations for Product Teams

Key Success Factors

- Gradual Feature Expansion: Build complexity slowly while monitoring user adoption and engagement metrics – following iterative product development principles

- Creator Integration: Develop artist tools that leverage social features for authentic fan engagement

- Privacy Transparency: Maintain clear communication about data usage and social feature implications

- Moderation Excellence: Invest heavily in content moderation systems that scale with user growth

Potential Pitfalls to Avoid

- Feature complexity that confuses core music consumption

- Privacy controversies that damage user trust

- Moderation failures that create safety concerns

- Over-aggressive monetization that feels extractive

What This Means for the Music Industry

Artist Strategy Evolution

Musicians must now consider social engagement within streaming platforms as seriously as traditional social media marketing. Native Spotify promotion through social features may become more effective than external platform dependence.

Label and Distributor Adaptation

Music industry professionals need strategies for leveraging social streaming features for artist development and promotion. This includes understanding how social signals affect algorithmic recommendation and playlist placement.

Fan Community Building

The shift toward platform-native social features changes how artists build and maintain fan communities. Spotify’s integrated approach may prove more sustainable than dispersed social media presence across multiple platforms.

Conclusion: The Strategic Inflection Point

Spotify’s Messages feature represents a strategic inflection point for music streaming platforms, arriving at what industry experts consider the optimal moment to challenge social media’s dominance in music discovery and sharing.

The measured approach – building on existing social features with careful privacy controls – addresses historical failure patterns while leveraging unprecedented user scale for meaningful network effects.

The business model implications overwhelmingly favor success, with social features driving user engagement, enabling premium differentiation, and creating competitive moats through network effects that compound over time.

Most significantly, Messages establishes infrastructure for the broader transformation of music streaming platforms into social audio ecosystems, potentially reshaping how users discover, share, and engage with music in an increasingly connected digital landscape.

The timing, scale, and strategic execution position Spotify to capture significant value from the convergence of social media and music streaming, marking what may prove to be the defining moment in the industry’s evolution toward authentic, community-driven music experiences.

For product teams, investors, and music industry professionals, this launch signals the beginning of a new competitive landscape where social features become as crucial as music catalog size and audio quality. The platforms that master this integration will likely dominate the next decade of digital music consumption – following patterns we’ve analyzed in platform competition dynamics.